Why Remuner

Product

Design & Flexibility

Incentive Plan Designer

Design the incentive plan your business needs.

Compensation Plan Manager

Seamlessly manage all your comp plans in a single place

Users & Teams Manager

Manage your team access to their incentive information

Challenges & Campaigns

Design gamified incentive plans that motivate your team

More about Design & Flexibility

Automation & Process Management

Automate real time calculations

Save your time for what really matters. Say goodbye to manual calculations

Period Closing Workflow

Manage validations and approval workflow for every incentive plan

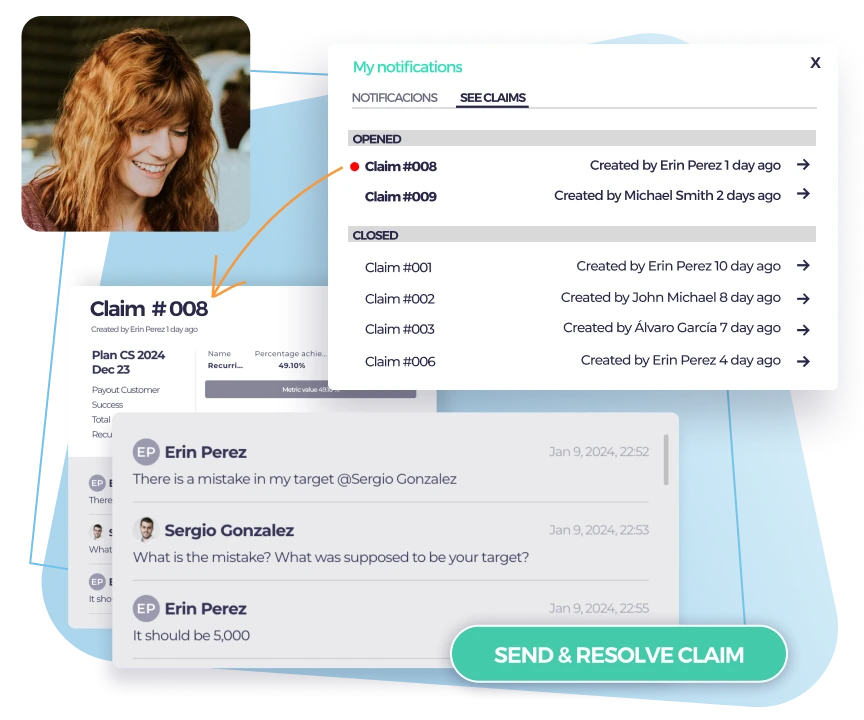

Claim Management

Centralize the conversation around variable remuneration

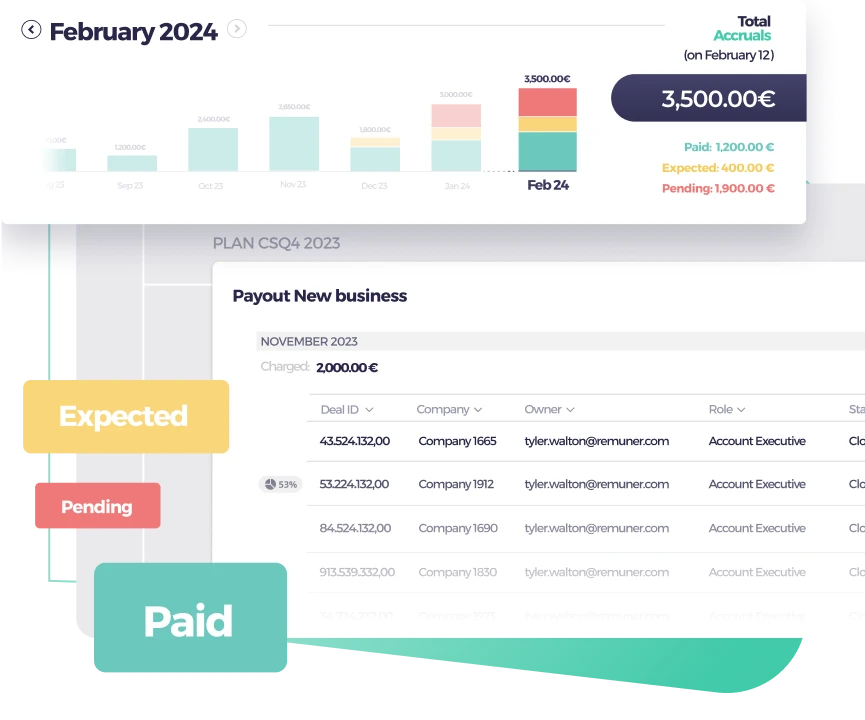

Accrual vs Payments

Decide how and when commissions are actually paid

More about Process & Admin management

Boost Performance

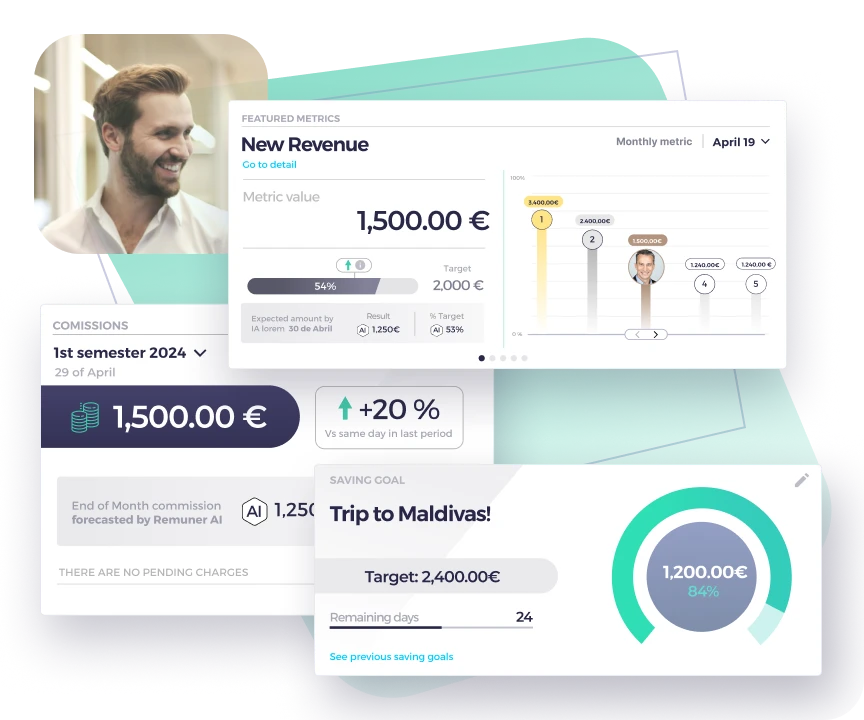

Real time Performance visibility

Boost team performance with real-time visibility

Dashboards and Reporting

Get real-time insights from your personalised dashboards

Compensation Plan Forecast

Earning simulation to boost motivation and performance

Remu, your AI Compensation Manager

Challenges & Campaigns

Design gamified incentive plans that motivate your team

More about Boost performance

————–

Integrations

Solutions

Customers

Pricing

Resources