Table of contents

Total contract value (TCV) is a crucial metric in sales compensation. It helps businesses understand the total revenue potential of a customer agreement over its entire term. For sales professionals, TCV directly impacts compensation structures, sales incentives, and quota attainment, making it an essential factor in commission planning.

This guide will explain what total contract value is, how to calculate it, and how it affects sales performance. We will also explore how businesses use TCV to forecast revenue and structure effective sales compensation plans.

What Is Total Contract Value?

Total contract value (TCV) represents the total revenue a company expects to earn from a customer contract over its entire duration. It includes:

✔ Recurring revenue (monthly or annual fees in subscription-based models)

✔ One-time fees (implementation, onboarding, or setup costs)

✔ Upfront payments or discounts (prepaid contracts or volume discounts)

Example of Total Contract Value Calculation

A SaaS company signs a 3-year contract with a client, where:

- The monthly recurring revenue (MRR) is $5,000

- A one-time implementation fee of $10,000 applies

TCV Formula: (MRR x Contract Term) + One-Time Fees

= ($5,000 x 36 months) + $10,000 = $190,000

In this case, the total contract value of this deal is $190,000, which serves as a key metric for quota setting and sales compensation.

TCV vs. ACV: What’s the Difference?

Total contract value (TCV) is often confused with annual contract value (ACV). While both measure revenue from a contract, they focus on different timeframes:

| Metric | Definition | Best For |

| TCV | Total revenue over the entire contract term | Long-term revenue forecasting, sales compensation planning |

| ACV | Annualized revenue per year of the contract | Year-over-year revenue tracking, short-term performance analysis |

Example:

A SaaS company closes a 5-year contract worth $250,000.

- TCV = $250,000

- ACV = $50,000 ($250,000 ÷ 5 years)

Both metrics help businesses evaluate customer lifetime value (LTV), set quota targets, and design pricing strategies.

How TCV Affects Sales Compensation

Sales professionals are often compensated based on quota attainment and commissions. Understanding total contract value helps businesses design fair and motivating sales incentive structures.

1. Commission Based on TCV

Some businesses calculate commissions as a percentage of the total contract value.

Example:

- A sales rep closes a $120,000 contract

- Their commission rate is 5% of TCV

- Earnings = $6,000 commission payout

This model ensures that long-term, high-value contracts generate higher commissions.

2. Quota Planning and TCV

Quota attainment is another important factor in sales compensation. Sales teams set quotas based on expected revenue per rep.

Example:

- A company sets a $1 million annual quota

- A rep closes four contracts worth $250,000 TCV each

- The rep meets their quota through TCV-based deals

By using TCV-based quotas, businesses can ensure that reps focus on high-value contracts rather than just deal volume.

3. TCV in SaaS Sales Compensation

In subscription-based business models, commissions may be based on ACV instead of TCV to avoid large upfront payouts.

Example:

- A rep closes a 3-year SaaS contract worth $180,000

- TCV = $180,000, ACV = $60,000

- The company pays commission only on the first-year ACV ($60,000) instead of the full contract value.

This approach ensures sales professionals receive consistent earnings while protecting company cash flow.

How to Increase Total Contract Value in Sales

1. Sell Multi-Year Contracts

Encourage customers to commit to longer contract terms.

- Example: Instead of offering one-year subscriptions, provide a discounted 3-year plan.

2. Upsell and Cross-Sell

Increase TCV by offering additional products or services.

- Example: A CRM provider adds a marketing automation tool, increasing contract value by 30%.

3. Reduce Churn Rate

Customer retention plays a key role in maximizing TCV.

- Example: A 10% churn reduction can lead to a 20% increase in total revenue over five years.

4. Offer Premium Packages

Higher-priced plans and enterprise solutions boost contract values.

- Example: Instead of selling a basic $1,000/month plan, upsell to a $2,500/month premium plan.

Challenges of Using Total Contract Value in Sales Compensation

While TCV is a valuable metric, businesses must handle certain challenges.

1. Cash Flow Management

- Solution: Use ACV-based commissions instead of paying upfront on full TCV.

2. High Churn Risks

- Solution: Implement customer success programs to reduce churn and protect revenue.

3. Inconsistent Sales Cycles

- Solution: Use TCV forecasting models to anticipate revenue fluctuations.

4. Setting Realistic Quotas

- Solution: Ensure quota targets reflect contract value and deal size variations.

Examples of TCV in Different Industries

1. SaaS Sales

- A SaaS startup signs a 2-year enterprise contract worth $500,000

- Sales reps earn commissions on TCV but receive payments in yearly installments

2. B2B Service Contracts

- A marketing agency signs a 3-year, $150,000 contract

- They offer discounts for long-term commitments, increasing retention

3. Manufacturing & Equipment Sales

- A machinery supplier signs a 5-year maintenance contract worth $1 million

- TCV helps the company predict long-term revenue stability

How to Track and Manage Total Contract Value

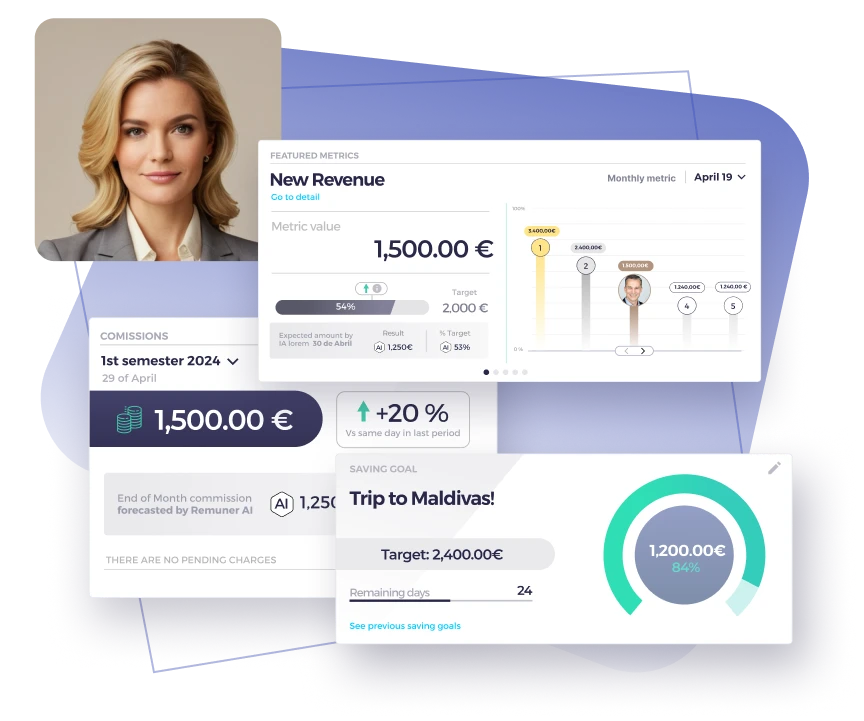

Tracking total contract value manually can be time-consuming and error-prone. Businesses use automated compensation platforms like Remuner to:

✔ Calculate TCV-based commissions accurately

✔ Monitor sales performance in real time

✔ Forecast long-term revenue trends

✔ Adjust compensation structures based on contract values

By using data-driven compensation tools, companies can ensure fair payouts, motivate sales teams, and drive revenue growth.

Final Thoughts

Total contract value is a critical metric for sales compensation. It helps businesses design effective commission plans, forecast revenue, and drive sales performance.

For companies looking to automate sales compensation tracking, Remuner provides a data-driven solution to manage TCV-based commissions, quota attainment, and revenue insights.

Want to streamline your compensation strategy? Discover how Remuner can optimize TCV-based commissions today.

FAQs About Total Contract Value in Sales Compensation

How is total contract value calculated?

Formula: (MRR x Contract Term) + One-Time Fees

Why is TCV important for sales compensation?

TCV determines commission payouts, quota targets, and long-term revenue forecasting.

Should commissions be based on TCV or ACV?

It depends. SaaS companies often use ACV, while one-time service contracts rely on TCV-based commissions.

How can businesses increase TCV?

By selling multi-year contracts, upselling premium services, and reducing churn rates.

How do companies track TCV and commission payouts?

Using automated compensation platforms like Remuner, which ensure accurate commission tracking and real-time performance monitoring.