Table of contents

For businesses operating with subscription-based models, Monthly Recurring Revenue (MRR) is a vital metric that tracks the predictable income generated from customers on a monthly basis. This consistent revenue stream allows businesses to plan better, forecast growth, and design effective sales compensation plans that keep the sales team focused on long-term goals.

In this blog, we’ll explore how MRR affects sales compensation and how aligning it with sales incentives, quotas, and on-target earnings (OTE) can boost overall sales performance. We’ll also explain the different types of MRR, why they matter, and how they can help you optimize your sales approach.

What is Monthly Recurring Revenue?

MRR refers to the revenue a company expects to earn each month from its subscription customers. Unlike one-time payments, this type of revenue provides ongoing predictability and stability, which is crucial for businesses that operate on a subscription-based business model, such as SaaS companies.

For example, if a company has 100 customers who each pay $100 monthly, the business can expect $10,000 in recurring revenue every month. This regular income helps companies maintain a stable financial foundation and scale over time. It’s also a key metric when setting sales compensation plans, as it encourages sales teams to focus on acquiring long-term customers and minimizing churn.

Key types of monthly recurring revenue

Understanding the different types of recurring revenue can help you design compensation plans that target the right goals. Let’s explore four key categories:

1. New Customer Revenue

This type of revenue comes from new customers signing up for a service. It’s critical for growth, and many sales teams have compensation plans designed to reward reps who bring in new business. The goal is to increase the number of subscribers and grow the company’s customer base over time.

For example, if a salesperson closes a deal with a customer who subscribes to a $500 monthly plan, that $500 adds to the company’s new customer revenue.

2. Expansion Revenue

Expansion revenue refers to additional income generated from existing customers who upgrade their plans or purchase more services. This could involve upselling a customer from a basic plan to a premium one or encouraging them to add more users to their account. Sales teams often have sales incentives that reward them for these upsells, as it helps increase the overall recurring revenue without having to acquire new customers.

For instance, if a customer starts with a $300 monthly plan and later upgrades to a $500 plan, the additional $200 is considered expansion revenue.

3. Churned Revenue

Churned revenue refers to the loss of recurring income when customers cancel their subscriptions. While this doesn’t directly impact most sales compensation plans, it’s important to track as it highlights retention issues within the business. If churn rates are high, sales teams may be encouraged to focus more on customer retention efforts.

4. Contraction Revenue

Contraction revenue occurs when a customer downgrades their subscription or reduces their usage. While the customer remains active, the revenue they contribute decreases. Keeping an eye on contraction revenue can help sales and customer success teams identify potential areas where additional support or new offerings might help retain higher-paying customers.

How recurring revenue shapes sales compensation plans

To create effective compensation plans, businesses need to consider how recurring revenue fits into their broader goals. Let’s look at how this influences key areas like quotas, OTE, and sales performance:

1. Quotas

In subscription businesses, sales teams are often assigned quotas based on how much new or additional recurring revenue they can bring in. These quotas reflect company goals and ensure that sales reps are focused on acquiring customers who contribute to predictable, ongoing income. A company might, for example, set a quarterly quota of $50,000 in new revenue for each sales rep, incentivizing them to bring in customers who pay on a monthly basis.

2. On-Target Earnings (OTE)

On-Target Earnings (OTE) represent the total expected earnings a salesperson can achieve if they meet their quotas. In a recurring revenue model, OTE might be closely tied to how much predictable income a rep can generate from both new and existing customers. This ensures that the compensation plan rewards not just one-time wins but long-term growth.

For instance, a salesperson with an OTE of $100,000 might have a base salary of $60,000, with the rest tied to meeting revenue targets. By consistently meeting or exceeding these targets, they can achieve their full earnings potential.

3. Sales Incentives

Sales incentives are designed to encourage specific behaviors. In a recurring revenue model, it’s important to align incentives with long-term goals such as customer retention and upselling. Instead of rewarding reps solely for closing deals, businesses should offer bonuses for securing longer-term contracts or upselling customers into higher pricing plans.

For example, a sales rep could receive a bonus for signing a customer to a one-year contract, which provides more predictable income than a month-to-month subscription. This way, the business builds revenue stability, while the sales team is rewarded for focusing on sustainable growth.

Strategies to Improve Sales Performance with Recurring Revenue

Focusing on predictable revenue as a key sales metric can significantly improve sales performance. Here are some strategies businesses can use:

1. Encourage Upselling and Cross-Selling

To maximize recurring revenue, encourage sales teams to focus on upselling and cross-selling opportunities. This increases revenue from existing customers, who are often more receptive to additional products or features. Aligning sales incentives with these goals ensures that sales reps are motivated to continuously provide value to customers and increase their lifetime value to the business.

2. Offer Incentives for Long-Term Contracts

Rewarding sales reps for securing long-term contracts can stabilize recurring revenue and reduce customer churn. Contracts that lock in customers for 12 months or more ensure steady income and build long-term customer relationships. Sales reps can be offered higher commissions or bonuses for these deals, further aligning their efforts with the company’s financial health.

3. Regular Performance Reviews

Businesses should regularly review how their sales teams are performing against revenue targets. By monitoring sales performance on a monthly basis, companies can identify top performers and offer additional incentives while coaching underperformers to help them meet their quotas. This helps ensure that all sales activities are contributing to predictable growth.

MRR vs. ARR: Advantages and Disadvantages

Monthly Recurring Revenue (MRR):

- Advantages:

- Provides a clear, detailed view of short-term revenue trends.

- Helps quickly spot fluctuations and adjust strategies accordingly.

- Ideal for businesses offering month-to-month contracts or flexible payment plans.

- Disadvantages:

- Less predictable in the long term, making financial planning more challenging.

- Higher potential for customer churn compared to annual contracts.

Annual Recurring Revenue (ARR):

- Advantages:

- Offers greater revenue predictability over a 12-month period, aiding long-term planning and forecasting.

- Reduces customer churn with annual contracts, providing more stability.

- Disadvantages:

- Less effective for tracking short-term revenue changes or identifying immediate business issues.

- May overlook month-to-month fluctuations, which can affect cash flow.

Both MRR and ARR serve important roles, and using them together can provide a comprehensive understanding of your business’s financial health.

Now that you know what is MRR

Recurring revenue is a powerful tool for driving long-term success in subscription-based businesses. By designing sales compensation plans that focus on growing and maintaining this revenue, businesses can create a more predictable and stable income stream while motivating their sales teams to prioritize long-term customer relationships.

Incorporating strategies like recurring revenue-based quotas, upsell incentives, and regular performance tracking into your sales compensation plans will not only help your business grow but also ensure that your sales team is focused on securing valuable customers that contribute to sustained financial health.

How can Remuner help you

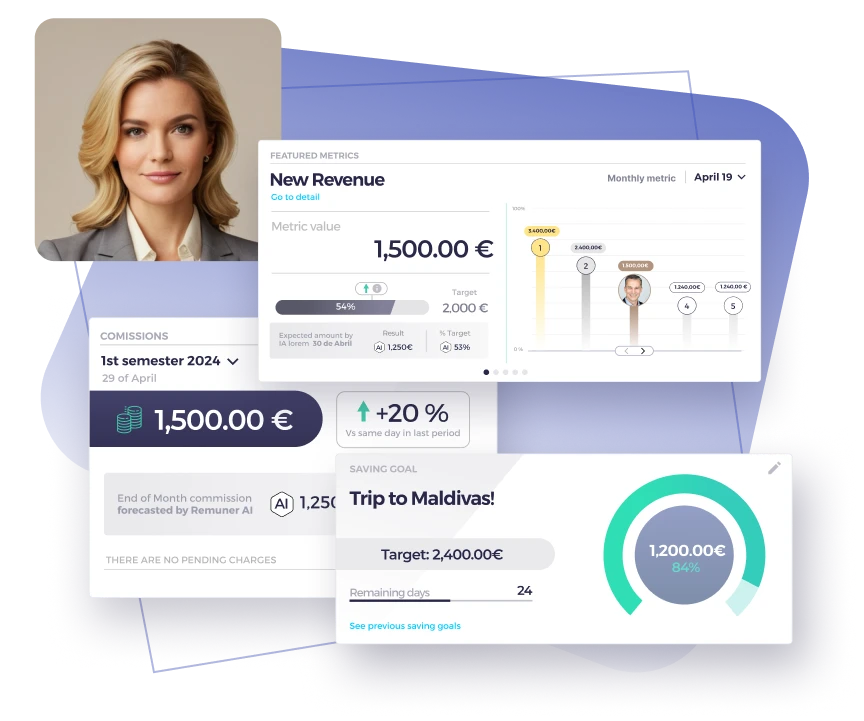

Managing sales compensation tied to recurring revenue can quickly become complex, especially as your team and customer base grow. This is where Remuner can make a difference. Remuner’s platform simplifies sales compensation by automating all aspects of commission management, from tracking monthly recurring revenue to calculating payouts in real-time. With seamless integration into your existing systems—CRMs, ERPs, and more—you can design any compensation plan you need, including those based on recurring revenue.

Our platform also provides valuable insights, real-time dashboards, and AI-driven sales coaching, ensuring your sales team stays motivated and aligned with business goals. Whether you need to track performance, set quotas, or adjust sales incentives, Remuner helps streamline the entire process so you can focus on driving growth and maximizing sales performance.