Table of contents

Sales compensation plays a crucial role in motivating sales reps, driving performance, and aligning sales teams with business goals. A well-structured compensation plan attracts and retains top sales talent while ensuring reps meet or exceed sales targets.

In this guide, we’ll break down the common types of sales compensation plans, provide real-world templates, and share best practices for designing a plan that boosts high performance.

What Is Sales Compensation?

Sales compensation refers to the financial rewards salespeople receive for achieving sales targets. It typically includes a mix of base salary, commissions, bonuses, and incentives. The right compensation plan motivates sales reps, aligns with organizational goals, and drives long-term success.

Key Components of Sales Compensation

- Base Salary: Fixed pay, regardless of performance.

- Commission: Variable pay based on sales volume.

- Bonuses: One-time rewards for hitting milestones.

- Incentives: Non-cash rewards (trips, gifts, stock options).

A well-balanced plan ensures sales reps stay motivated while keeping costs sustainable. Commission structures must comply with state labor laws. For example, New York requires written agreements for recoverable draws. Refer to the NY DOL’s commission pay guidelines for legal specifics.

6 Sales Compensation Plan Examples

To help you understand how different compensation structures work in practice, here are real-world examples for each of the 6 common sales compensation plans.

1. Salary-Only Plan Example

Best for: Enterprise sales reps, account managers, or roles with long sales cycles.

Structure:

- Base Salary: $90,000/year (no commission or bonuses).

- Additional Perks: Stock options, annual profit-sharing.

When to Use It:

- When sales cycles exceed 6+ months (e.g., enterprise SaaS, medical device sales).

- For roles focused on relationship management rather than pure revenue generation.

Pros:

✅ Predictable income for reps.

✅ Reduces pressure to close deals prematurely.

Cons:

❌ Limited motivation to exceed targets.

2. Commission-Only Plan Example

Best for: High-velocity sales (real estate, auto sales, freelance sales).

Structure:

- Commission Rate: 10% of total deal value.

- No Base Salary: Reps earn $0 if they don’t sell.

Example Earnings:

- Deal 1: 50,000 sale→5,000 commission

- Deal 2: 100,000 sale→10,000 commission

- Total Monthly Earnings: $15,000 (uncapped)

When to Use It:

- Industries with short sales cycles and high transaction values.

- For independent contractors or 1099 sales reps.

Pros:

✅ Unlimited earning potential.

✅ Highly motivating for aggressive sellers.

Cons:

❌ High turnover risk (reps leave if they have a bad month).

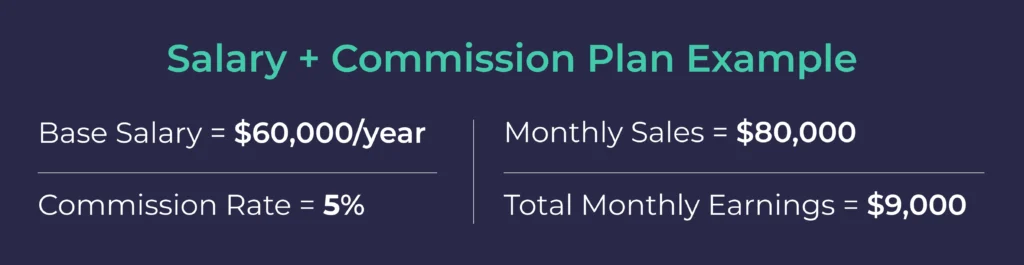

3. Salary + Commission Plan Example

Best for: Most B2B sales teams (SDRs, AEs, mid-market sales).

Structure:

- Base Salary: $60,000/year

- Commission: 5% of closed deals

Example Earnings:

- Monthly Sales: $80,000

- Commission (5%): $4,000

- Total Monthly Earnings: 5,000(base)+4,000 = $9,000

When to Use It:

- For balanced motivation and stability.

- When you want reps to focus on both small and large deals.

Pros:

✅ Steady income + performance incentives.

✅ Attracts both risk-averse and high-performing reps.

Cons:

❌ Can be costly if base salaries are too high.

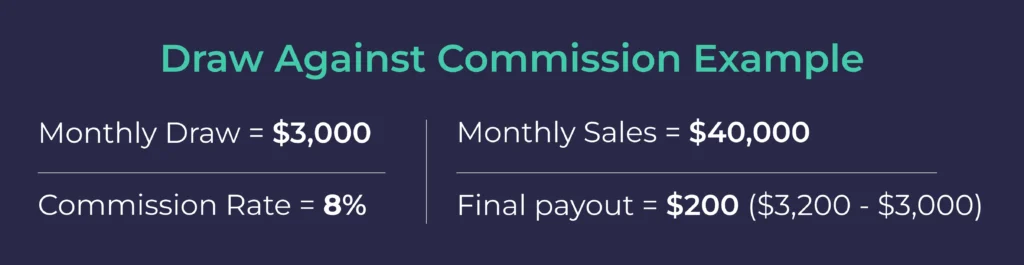

4. Draw Against Commission Example

Best for: New hires, startups, or industries with irregular sales cycles.

Structure:

- Monthly Draw: $3,000 (recoverable advance).

- Commission Rate: 8% of sales.

How It Works:

- If a rep closes $40,000 in sales:

- Commission (8%): $3,200

- Draw already paid: $3,000

- Final payout: 200 (3,200 – $3,000)

- If a rep closes $20,000:

- Commission (8%): $1,600

- Draw owed back: 1,400 (3,000 – $1,600)

When to Use It:

- For ramping new hires who need time to build a pipeline.

- In seasonal industries (e.g., insurance, real estate).

Pros:

✅ Provides financial security during slow periods.

Cons:

❌ Reps may owe money back if they underperform.

5. Tiered Commission Plan Example

Best for: Encouraging reps to exceed quotas.

Structure:

- Quota: $50,000/month

- Tier 1 (0-50K): 5% commission

- Tier 2 (50-100K): 8% commission

- Tier 3 (100K+): 12% commission

Example Earnings:

- Sales: $120,000

- First 50K→ 2,500 (5%)

- Next 50K→ 4,000 (8%)

- Last 20K→ 2,400 (12%)

- Total Commission: $8,900

When to Use It:

- To reward overperformance without raising base salaries.

- For high-growth startups pushing aggressive targets.

Pros:

✅ Drives reps to go beyond quota.

Cons:

❌ Can be complex to track manually (use Remuner’s commission software).

6. Profit-Based Commission Example

Best for: Companies focused on profitability over revenue.

Structure:

- Commission: 15% of deal profit (revenue – costs).

Example Earnings:

- Deal Revenue: $100,000

- Product Cost: $40,000

- Profit: $60,000

- Commission (15%): $9,000

When to Use It:

- For custom or negotiated deals with varying margins.

- In manufacturing or services where costs fluctuate.

Pros:

✅ Aligns sales with company profitability.

Cons:

❌ Requires transparent cost tracking.

Which Plan Is Right for Your Team?

| Plan Type | Best For | Risk Level |

|---|---|---|

| Salary-Only | Long-cycle sales, account managers | Low |

| Commission-Only | Real estate, freelance sales | High |

| Salary + Commission | Most B2B sales teams | Medium |

| Draw Against Comm. | New hires, seasonal industries | Medium |

| Tiered Commission | Startups, high-growth teams | Medium-High |

| Profit-Based | Margin-sensitive businesses | Medium |

Need Help Managing Sales Compensation?

Tracking commissions manually leads to errors, disputes, and demotivated reps. Remuner’s commission tracking software automates payouts, ensures accuracy, and keeps your team motivated. Try Remuner today and let us help you. Book a demo for free today!

3 Sales Compensation Templates for Different Scenarios

To help you design the right plan, here are three practical templates:

Template 1: Straight Commission Plan

| Metric | Rate |

|---|---|

| Sales up to $50K | 5% commission |

| Sales 50K–50K–100K | 7% commission |

| Sales above $100K | 10% commission |

Best for: High-velocity sales teams with short cycles.

Template 2: Salary + Bonus Structure

| Component | Details |

|---|---|

| Base Salary | $50,000/year |

| Quarterly Bonus | $2,500 for 100% quota attainment |

| Annual Bonus | $5,000 for exceeding annual target |

Best for: Mid-market sales roles with steady pipelines.

Template 3: Team-Based Commission

| Metric | Payout |

|---|---|

| Team hits 90% quota | 3% shared pool |

| Team hits 100%+ | 5% shared pool |

Best for: Collaborative sales environments.

Learn how to calculate commission in Excel thanks to our step-by-step guide. Take a look here!

4 Sales Compensation Plan Examples for Different Roles

A well-structured sales compensation plan aligns incentives with business goals and motivates teams to perform at their best. Below, we’ll explore four tailored compensation plans for different sales-related roles: Customer Success, Sales Development Reps (SDRs), Revenue Operations (RevOps), and Enterprise Sales.

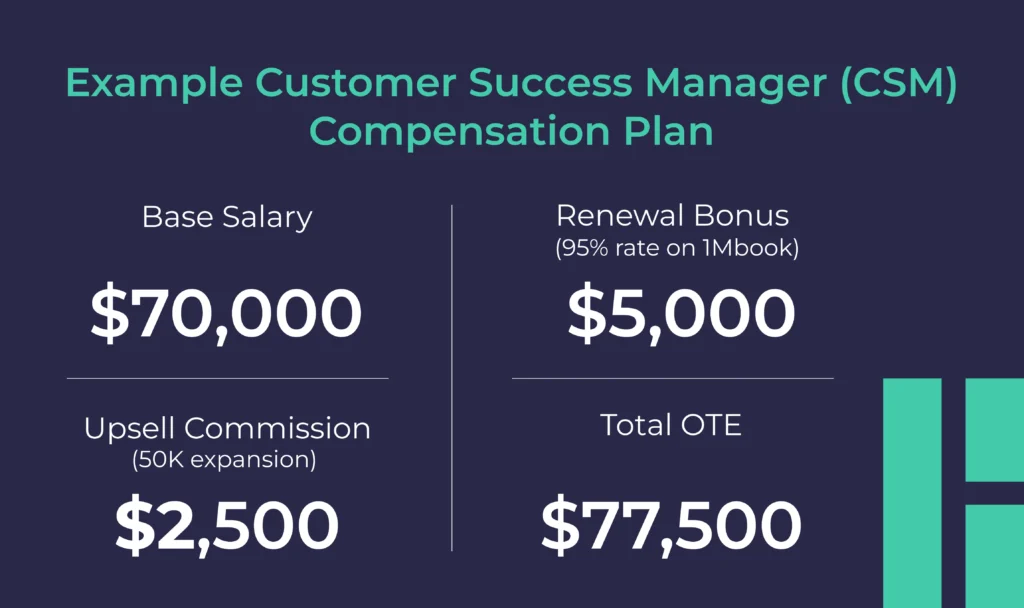

1. Customer Success Manager (CSM) Compensation Plan

Role Focus: Renewals, upsells, and customer retention.

Compensation Structure:

- Base Salary: 70% of total compensation

- Variable Pay (30%):

- Renewal Rate Bonus (15%): Earn 5% of contract value for 90%+ renewal rate.

- Upsell/Cross-Sell Commission (15%): 3-7% of net new expansion revenue.

Example Earnings Calculation:

- Base Salary: $70,000

- Renewal Bonus (95% rate on 1Mbook): 5,000

- Upsell Commission (50K expansion): 2,500

- Total OTE: $77,500

Best For: SaaS companies with recurring revenue models.

2. Sales Development Rep (SDR) Compensation Plan

Role Focus: Lead generation and pipeline creation.

Compensation Structure:

- Base Salary: 60% of total compensation

- Variable Pay (40%):

- Per Qualified Meeting Booked: 50−150 per meeting (tiered based on lead quality).

- Monthly Bonus: $500 for hitting 120%+ of quota.

Example Earnings Calculation:

- Base Salary: $45,000

- Meetings Booked (30/month at 100avg): 36,000

- Bonus (3 months at 120%+ quota): $1,500

- Total OTE: $82,500

Best For: High-growth startups needing pipeline acceleration.

3. Revenue Operations (RevOps) Compensation Plan

Role Focus: Sales efficiency, process optimization, and data-driven decision-making.

Compensation Structure:

- Base Salary: 80% of total compensation

- Variable Pay (20%):

- Team Quota Attainment Bonus (10%): Paid if sales team hits 100%+ quota.

- Process Improvement Bonus (10%): Based on measurable efficiency gains (e.g., reduced sales cycle time by 15%).

Example Earnings Calculation:

- Base Salary: $90,000

- Team Quota Bonus (10% of variable): $9,000

- Process Improvement Bonus: $9,000

- Total OTE: $108,000

Best For: Scaling companies investing in sales infrastructure.

4. Enterprise Account Executive (AE) Compensation Plan

Role Focus: Closing large, complex deals.

Compensation Structure:

- Base Salary: 50% of total compensation

- Variable Pay (50%):

- Commission (40%): 8-12% of deal revenue (uncapped).

- Strategic Deal Bonus (10%): Additional 2% for deals over $250K.

Example Earnings Calculation:

- Base Salary: $75,000

- Commission (500K closed): 50,000

- Strategic Bonus (300K deal): 6,000

- Total OTE: $131,000

Best For: B2B companies with high-value, long-cycle deals.

Key Takeaways

- Customer Success: Focus on retention and expansion.

- SDRs: Reward pipeline generation with clear per-meeting payouts.

- RevOps: Tie bonuses to team performance and efficiency gains.

- Enterprise AEs: High-risk, high-reward with uncapped commissions.

Need help automating and managing these comp plans? Remuner’s commission tracking software ensures accurate, transparent payouts for every role.

How to Design a Sales Compensation Plan (Best Practices)

- Align with Business Goals – Ensure comp plans support company’s growth targets.

- Keep It Simple – Complex plans confuse reps and reduce motivation.

- Benchmark Against Competitors – Stay competitive to attract and retain top sales talent.

- Use Commission Tracking Software – Automate payouts and reduce errors. (Remuner offers seamless commission tracking—learn more here).

- Review & Adjust Regularly – Update plans based on market changes and rep feedback.

Research shows that non-cash incentives (e.g., recognition, career growth) can be as powerful as monetary rewards. For a deeper dive, read Harvard Business Review’s study on how to really motivate salespeople.

How Remuner Simplifies Sales Compensation Management

Managing sales compensation manually leads to errors, delays, and frustrated reps. Remuner automates commission tracking, ensures accurate payouts, and provides real-time performance insights.

With Remuner, sales managers can:

- Set up custom comp plans in minutes.

- Track quotas and commissions effortlessly.

- Motivate sales reps with transparent earnings dashboards.

Explore Remuner’s solution to streamline your sales compensation process.

FAQs

1. What is OTE in sales compensation?

OTE (On-Target Earnings) is the total pay a rep earns when hitting 100% of their quota. It includes base salary + commissions/bonuses.

2. How often should I review my sales compensation plan?

Review plans annually or whenever market conditions, business goals, or sales strategies shift.

3. What’s the best commission structure for SaaS sales?

A mix of base salary + recurring revenue commissions works well for SaaS due to long sales cycles.

4. How do I motivate underperforming sales reps?

Adjust quotas, offer training, or introduce short-term incentives to boost morale.

5. Can commission tracking software improve sales performance?

Yes! Tools like Remuner increase transparency, reduce disputes, and keep reps focused on selling.

By implementing the right sales compensation plan, you’ll motivate sales reps, attract top performers, and drive revenue growth. Need help automating commissions? Book a demo with Remuner and we’ll help you!