Table of contents

Sales commission rates play a big part in motivating sales teams and boosting business growth. However, these rates differ across industries, reflecting factors like deal sizes, sales cycles, and market demands. Knowing the average sales commission rates by industry helps companies set fair compensation plans that drive better sales performance.

This guide explains how commission rates work, shares examples from different sectors, and offers tips for aligning rates with sales incentives, quotas, and on-target earnings (OTE).

What are sales commission rates?

Sales commission rates are percentages or fixed amounts paid to salespeople based on the revenue they generate. These rates encourage sales teams to meet targets by linking their earnings directly to sales. Sales commission structure can vary. It might be a flat rate for all sales, higher rates for bigger sales, or a mix of base pay and commission. The right structure helps motivate teams, improve performance, and reach company goals.

What affects sales commission rates?

Several factors determine how commission rates are set across different industries. Here are some common influences:

- Deal size: Larger deals often mean lower commission percentages because even a small rate can result in a big payout. On the other hand, industries with smaller deal sizes tend to offer higher commission rates to make up for the lower revenue per sale.

- Sales cycle length: In industries like software or enterprise services, the sales cycle can be long, leading to lower commission rates. Shorter sales cycles in retail or consumer goods usually come with higher rates to encourage quick sales.

- Market competition: In highly competitive industries, companies may offer higher commissions to attract and keep top sales talent. For example, sales roles in real estate or insurance might have higher commission rates because there’s strong competition for the best performers.

- Quota requirements: How much salespeople are expected to sell influences commission rates. Companies may offer higher rates if quotas are challenging, pushing salespeople to aim for more. This approach is common in industries where closing deals can be complex, like technology or healthcare.

- Base pay and OTE: Some industries offer higher base salaries, leading to lower commission rates, while others have lower base pay but higher commissions to keep the total on-target earnings (OTE) attractive. Balancing base pay with commissions helps companies create fair and motivating compensation plans.

Sales commission rates by industry: Examples

Now, let’s look at the average sales commission rates in various sectors. This will help show how different industries set their sales commission structures based on unique business needs.

1. Technology and software

- Average rate: 5-10%

- Typical structure: In tech, commission rates are moderate because deals can be large and sales cycles are often long. Compensation usually combines a solid base pay with commission. Rates may vary depending on the sales role, whether the person is focused on new sales, renewals, or upselling.

- Example: A tech company might offer a 7% commission on new software sales, but raise the rate to 10% for hitting 120% of the quota. This encourages higher performance.

- Company examples: Hubspot, Microsoft, Oracle

2. Real estate

- Average rate: 3-6% of the property sale price

- Typical structure: Commissions in real estate are a percentage of the property’s sale value. Because property prices are high, even a lower commission rate can be a significant amount. Agents may share commissions with brokers or other team members.

- Example: If a real estate agent sells a $400,000 house with a 5% commission rate, the total commission is $20,000, which could be split between the buying and selling agents.

- Company examples: Keller Williams, Century 21, RE/MAX

3. Financial services (insurance, investments)

- Average rate: 5-15%

- Typical structure: Higher commission rates in this sector reflect the effort needed to close sales and the competition for top talent. Insurance sales, for example, often include ongoing commissions for policy renewals.

- Example: An insurance agent might get a 12% commission on the first year’s premium for a new policy, plus 5% on each renewal. This encourages long-term client relationships.

- Company examples: New York Life, Prudential, Edward Jones

4. Consumer goods and retail

- Average rate: 8-20%

- Typical structure: Higher commission rates are common in retail because the goal is to encourage sales in a fast-paced environment. The commission often varies depending on the value and profit margin of the products.

- Example: For electronics, a salesperson might earn a 10% commission, while luxury fashion items could have a commission rate of 15-20%, given the higher profit margins.

- Company examples: Best Buy, Nordstrom, CarMax

5. Pharmaceuticals and medical devices

- Average rate: 5-10%

- Typical structure: In medical sales, commission rates are often lower, balanced out by high base salaries. The sales cycle is usually long, with sales roles requiring in-depth product knowledge and time to close deals.

- Example: A medical device rep might earn a 6% commission on a $50,000 equipment sale. Additional bonuses may be available for meeting or exceeding quota.

- Company examples: Medtronic, Johnson & Johnson, Pfizer

6. Advertising and media

- Average rate: 10-25%

- Typical structure: Higher commissions in advertising reflect the need for quick deal-making and the relatively lower base pay in sales roles. Short sales cycles make it essential to keep commission rates high to motivate fast performance.

- Example: A media sales representative might get a 20% commission for ad space sold, pushing for fast closures and repeat business.

- Company examples: Comcast, Yelp, iHeartMedia

How to align commission rates with industry standards

Setting the right sales commission rates ensures that compensation is fair and motivating. Here are some ways to align your rates with what is common in your industry:

1. Benchmark against average rates

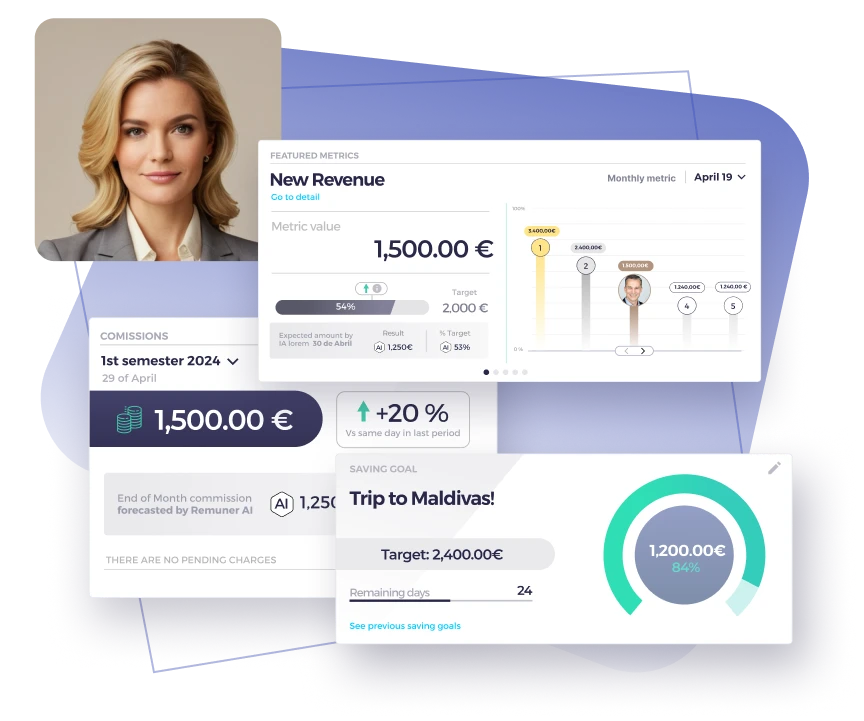

Check the average sales commission rates by industry to see what competitors offer. Tools like Remuner can help you compare rates and adjust your sales commission structure based on current standards.

2. Use a tiered commission structure

Increasing commission rates as salespeople achieve higher sales volumes can encourage them to push harder. For example, a 5% rate up to quota and 8% for exceeding 120% of quota rewards extra effort.

3. Balance base pay and commission

Make sure the base rate and commission together create attractive OTE. For roles with lower base pay, consider higher commission rates to keep earnings competitive.

Sales commission rates and their effect on performance

How you set commission rates impacts sales performance directly. Higher commission rates can motivate teams, but only if they believe the targets are realistic. When commission structures are confusing or quotas seem impossible, it can hurt motivation.

- Keep it simple: The sales commission structure should be clear. When salespeople understand how they earn commissions, it encourages them to push for higher sales. With platforms like Remuner, real-time updates on performance help keep teams motivated.

- Use meaningful metrics: Tie commissions to metrics that matter most to the business, like revenue growth, new customer acquisition, or customer retention. Setting up compensation plans around relevant metrics ensures teams stay focused on company goals.

- Look at long-term growth: High commission rates can drive short-term gains, but make sure your plans support long-term success. Focus on metrics like customer lifetime value and retention for sustainable growth.

Optimizing sales compensation plans

To get the best results from your sales commission plans, make data-driven choices. Regularly update quotas, compare sales commission rates by industry, and adjust your sales commission structure as needed. Tools like Remuner automate compensation management, providing insights that help you optimize plans and boost sales performance.

- Review commission rates regularly: Stay competitive by adjusting rates based on industry trends and company goals. This keeps your sales roles attractive to top talent.

- Set realistic quotas: Make sure quotas are achievable yet challenging. High enough to motivate but realistic enough to prevent discouragement.

- Automate compensation tracking: Use software like Remuner to streamline commission management, reduce errors, and keep your teams focused on selling.

Examples of balancing commission rates and base pay

- High commission, low base pay: Retail sales roles often use this approach, offering lower base pay but higher commission rates to motivate high-volume sales. For instance, a retail associate with a base rate of $12/hour might earn a 15% commission on sales above a certain threshold.

- Low commission, high base pay: In industries like medical devices, sales reps might have a high base salary, with lower commission rates due to long sales cycles and complex sales processes. A rep could have a $70,000 base salary with a 6% commission on equipment sales.

- Balanced approach: A technology company may offer a balanced plan with moderate base pay and commission rates, providing stability while still rewarding high performance. For example, a base pay of $50,000 plus a 7% commission on new sales encourages consistent effort.

Now you can start setting effective compensation plans

Understanding sales commission rates by industry is crucial for setting effective compensation plans. Factors like deal size, sales cycle length, market competition, quota requirements, and OTE play roles in determining the right rates. With the right strategies, you can motivate your sales team and maximize sales performance.

Whether you’re setting up new compensation plans or updating existing ones, regularly reviewing your sales commission structure and comparing average sales commission rates by industry will help you stay competitive. With automated tools like Remuner, managing compensation plans becomes easier, keeping your teams motivated and focused on reaching ROI.