Table of contents

Net retention rate (NRR) is one of the most critical metrics for subscription-based businesses, especially in SaaS. It measures how much revenue a company retains from existing customers over time, factoring in expansions, upgrades, downgrades, and churn.

A high NRR indicates strong customer satisfaction and revenue growth, making it essential for sales performance, compensation planning, and long-term business success.

This guide will break down what net retention rate is, how to calculate it, and how it impacts sales incentives and quota attainment. We’ll also explore strategies to improve NRR and ensure sustainable revenue growth.

What Is Net Retention Rate (NRR)? Definition and Importance

Net retention rate (NRR), also known as net revenue retention, measures how well a company retains and grows revenue from its existing customer base. It accounts for:

✔ Recurring revenue from existing customers

✔ Expansion revenue from upsells, cross-sells, and add-ons

✔ Revenue lost from downgrades and churn

NRR is especially important for SaaS and subscription-based companies, where long-term customer relationships drive sustainable growth. A good net retention rate is typically greater than 100%, meaning the company is growing revenue from existing customers even before acquiring new ones.

NRR is especially important for SaaS and subscription-based companies, where long-term customer relationships drive sustainable growth. HubSpot’s guide on SaaS metrics highlights how NRR helps businesses measure customer retention and expansion revenue effectively.

How to Calculate Net Retention Rate

The formula to calculate NRR is:

NRR (%) =

((Starting MRR + Expansion Revenue – Churned Revenue – Contractions) ÷ Starting MRR) x 100

Where:

- Starting MRR = Monthly recurring revenue at the beginning of the period

- Expansion Revenue = Additional revenue from upsells, cross-sells, and renewals

- Churned Revenue = Revenue lost from customer cancellations

- Contractions = Revenue lost from downgrades or reduced usage

Example Calculation

A SaaS company starts the month with $100,000 MRR. Over the month:

- They generate $20,000 from expansions and upsells

- They lose $10,000 due to customer churn

- They lose $5,000 from customers downgrading plans

NRR Calculation:

NRR = ((100,000 + 20,000 – 10,000 – 5,000) ÷ 100,000) x 100 = 105%

An NRR of 105% means the company is growing revenue from existing customers, even with some churn.

Net Retention Rate vs. Gross Retention Rate: Key differences

NRR is often compared with gross revenue retention (GRR), but they measure different aspects of revenue retention:

| Metric | Definition | Includes Expansion Revenue? | Focus |

| Net Retention Rate (NRR) | Measures retained revenue from existing customers, including upgrades and downgrades | Yes | Growth-oriented |

| Gross Retention Rate (GRR) | Measures how much revenue is retained without expansion | No | Churn-focused |

Key Takeaways:

- NRR above 100% means existing customers are driving revenue growth.

- GRR below 90% signals high churn, even if NRR looks strong.

How Net Retention Rate Affects Sales Compensation

1. Aligning Sales Incentives with Net Retention Rate

A compensation plan should reward both customer acquisition and long-term retention. If sales teams only focus on closing new deals, they might not prioritize customer satisfaction, leading to higher churn.

- Solution: Link commissions and sales incentives to NRR to ensure reps drive long-term value.

Example: Commission Based on NRR

A SaaS company offers:

-

- 5% commission on the total contract value (TCV) at the time of sale

-

- An additional 2% commission if the customer renews after 12 months

-

- Bonus payouts if the account expands beyond the original contract value

This approach motivates reps to sell high-value deals and ensure customers remain engaged.

2. Quota Planning and NRR

Quota attainment should reflect customer retention and expansion revenue, not just new sales.

Example: NRR-Based Quota Target

- A sales rep has a $1M annual quota

- $700,000 from new deals

- $300,000 from expansion revenue (upsells, renewals, cross-sells)

This quota structure encourages reps to focus on long-term customer success and reducing churn.

3. Reducing Churn Through Sales Compensation

High churn rates lower NRR, impacting revenue and sales performance. Compensation models should incentivize reps to:

✔ Sell to ideal customer profiles (ICPs) to ensure better retention

✔ Set realistic expectations during the sales process

✔ Work closely with customer success teams to monitor expansion opportunities

Companies with NRR-based compensation often see higher customer satisfaction and better revenue growth.

4 Proven Strategies to Improve Net Retention Rate

1. Prioritize Customer Success

- Assign dedicated account managers to high-value customers

- Offer exclusive training and onboarding programs

- Set quarterly check-ins to ensure customer satisfaction

2. Implement Expansion Revenue Strategies

- Upsell premium features or higher-tier plans

- Cross-sell complementary products

- Offer discounted long-term contracts

3. Reduce Churn Rate

- Identify at-risk customers early using churn prediction models

- Create a win-back program for customers considering cancellations

- Gather customer feedback to improve product offerings

4. Use Data to Monitor NRR Performance

- Track monthly recurring revenue (MRR) and expansion revenue

- Segment customers by retention risk level

- Use automated compensation software to align incentives with revenue retention

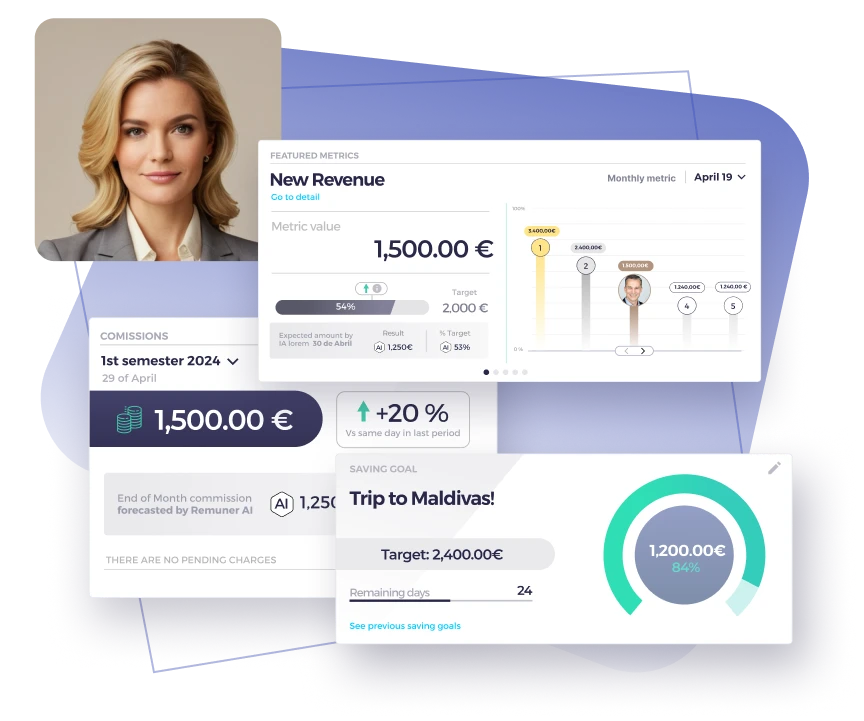

Remuner helps businesses track net retention rate, monitor expansion revenue, and automate sales compensation, ensuring reps are rewarded for long-term customer success.

Net Retention Rate in Different Industries

SaaS Companies

- A SaaS company tracks NRR to measure revenue from renewals, upgrades, and downgrades.

- They offer bonus commissions for reps who maintain high customer retention.

Subscription-Based Businesses

- A streaming service increases NRR by launching personalized content recommendations, reducing churn.

Financial Services

- A fintech company uses NRR to evaluate customer loyalty and upsell investment products.

Final Thoughts: Why NRR Is Key to Long-Term Revenue Growth

Net retention rate is a key indicator of long-term revenue growth. By aligning sales compensation with retention and expansion, businesses can drive sustainable sales performance while maximizing customer value. Ready to optimize your sales compensation plan? Discover how Remuner’s tools can help you track and automate commissions, and boost revenue growth. Book a demo for free today!

FAQs About Net Retention Rate

How is net retention rate calculated?

NRR = ((Starting MRR + Expansion Revenue – Churned Revenue – Contractions) ÷ Starting MRR) x 100

What is a good net retention rate?

For SaaS companies, NRR above 100% is ideal. The best companies achieve 120%+.

Why does NRR matter for sales compensation?

NRR determines long-term revenue potential and helps structure commissions based on customer retention and upsells.

How can businesses increase NRR?

By improving customer success, reducing churn, and incentivizing expansion revenue through aligned compensation plans.

How do companies track NRR and commission payouts?

Using automated compensation platforms like Remuner, which provide real-time tracking, quota alignment, and revenue forecasting.