Table of contents

How to calculate commission?

To learn how to calculate commission, multiply total sales by the commission rate: Commission = Total Sales × Commission Rate. If the employee also receives a base salary, add it to the commission to determine total income. For example, $50,000 in sales at a 10% rate earns $5,000 in commission.

Why is commission calculation important?

Calculating commission correctly not only ensures sales reps receive the compensation they deserve, but it also aligns their efforts with the company’s revenue goals. A well-structured commission plan keeps reps motivated to close deals while making sure the company achieves its sales targets. Incorrect calculations or misaligned incentives can demotivate employees, leading to underperformance and confusion. Understanding how to calculate commission and integrate it into compensation plans is a crucial step in driving consistent sales performance.

Common commission structures

Before diving into how to calculate commission, it’s important to understand the different types of commission structures. The commission model you use will impact the calculation method.

1. Straight commission: Reps earn a percentage of every sale they make. This model is simple but offers high reward potential.

Example: A rep closes a deal worth $10,000 with a 5% commission rate. The commission would be:

2. Base salary plus commission: Reps receive a base salary and earn additional commission on sales. This provides more financial stability while still rewarding performance.

- Example: A rep has a $50,000 base salary and earns a 5% commission on sales. If they make $100,000 in sales, they receive:

3. Tiered commission: Reps earn higher commission rates as they surpass different sales thresholds or quotas, encouraging higher performance.

- Example: A rep earns 3% on the first $50,000 of sales and 6% on anything beyond that. For $70,000 in sales:

4. Accelerators: Reps earn higher commissions once they surpass their quota. This model motivates reps to go beyond the basic target.

- Example: A rep with a $100,000 quota earns 5% up to $100,000, then 10% on everything beyond that. For $120,000 in sales:

Step-by-step guide on how to calculate commission

1. Calculate the total sales achievement

The first step is identifying the total value of the sales made by the rep. This can be the total revenue from all closed deals in a given period. This KPI is key to calculate the sales quota achievement.

2. Define the commission rate

Determine the percentage rate at which the commission will be applied. The rate depends on the compensation plan, which could include flat rates, tiered commissions, or accelerators.

3. Calculate the base commission

Multiply the sales value by the commission rate to calculate the base commission.

- Example: If a rep makes $50,000 in sales and the commission rate is 5%, the calculation is:

4. Apply any additional incentives

If the commission plan includes tiered rates, accelerators or spiffs, calculate the extra commissions separately and add them to the base commission.

5. Account for deductions or adjustments

Some compensation plans may include clawbacks or deductions for returns or cancellations. Be sure to account for these in the final commission amount.

- Example: If a rep earns 6% for exceeding their quota and they’ve closed $60,000 in sales (with a quota of $50,000), the commission would be:

Real-life examples of how to calculate commission

Example 1: Straight commission structure

A sales rep works on a straight commission plan, earning 7% of all sales. In one month, they close deals worth $150,000. Their commission is calculated as:

Example 2: Tiered commission structure

A rep’s company uses a tiered commission structure, paying 4% for sales up to $75,000 and 8% for sales beyond that. If the rep generates $120,000 in sales:

Example 3: Base salary plus commission

A rep has a base salary of $40,000 and earns 6% commission on total sales. If they make $200,000 in sales, the total compensation (base salary + commission) would be:

Companies are increasingly adopting transparent and equitable compensation models to attract and retain top sales talent. According to a Harvard Business Review article, organizations that embrace pay transparency see higher employee satisfaction and retention rates. By aligning pay structures with performance metrics and openly communicating how commissions are calculated, businesses can foster trust, fairness, and motivation across their teams.

The role of sales quota and OTE in calculating commission

Sales quota and OTE play critical roles in calculating commissions. A quota is the sales target set for reps, while OTE represents the total expected earnings if they meet their quota. Commission plans should be designed so that reps can meet or exceed their On Target Earnings by hitting their quota and benefiting from any accelerators or bonuses.

For example, if a rep’s OTE is $100,000, with a $50,000 base salary, the remaining $50,000 comes from commission. If their commission rate is 5%, they would need to close $1,000,000 in sales to meet their quota and hit their OTE:

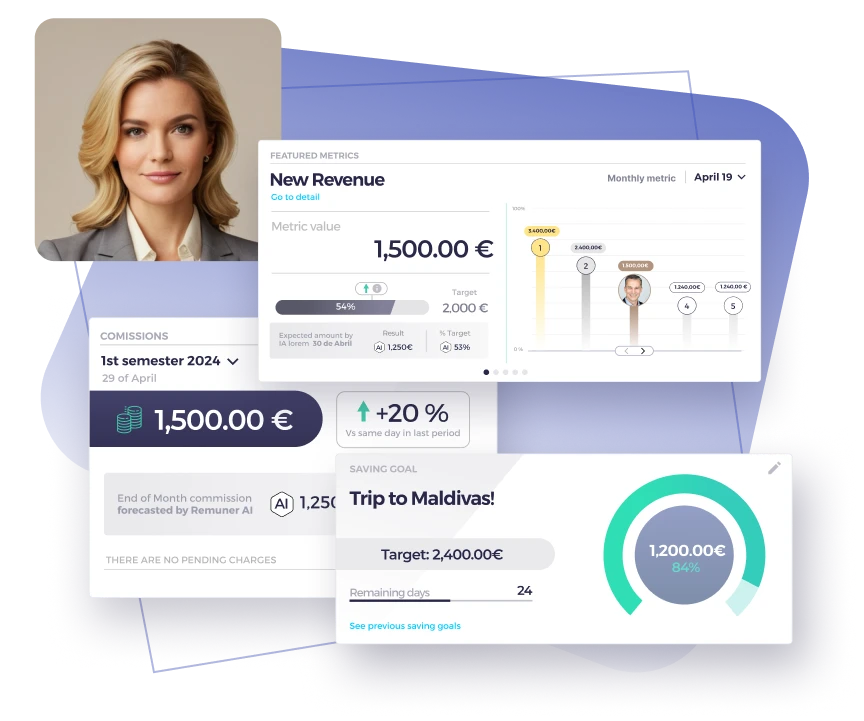

Simplify your commission calculation with Remuner

Manually calculating commissions can be time-consuming and prone to errors, especially when dealing with complex structures like tiered commissions, accelerators, and variable rates. With Remuner, you can automate the entire process, ensuring accuracy and transparency.

Remuner effortlessly connects to your existing systems such as CRMs and ERPs, pulling in the necessary data to calculate commissions in real-time. You can customize your compensation plans using a no-code designer, making it easy to adjust for OTE, quota, and sales performance metrics without the hassle of manual calculations.

By leveraging Remuner’s platform, your teams gain full visibility into their commission plans, removing any guesswork and allowing them to focus on closing deals. Managers and finance teams benefit from streamlined workflows and actionable insights, ensuring that commissions align with company goals while motivating your sales force.

FAQs About How to Calculate Commission

1. What is the formula to calculate commission?

The basic formula is: Commission = Total Sales × Commission Rate. If there’s a base salary, add it separately to determine total compensation.

2. What types of commission structures exist?

Common structures include straight commission, base salary plus commission, tiered commission, and accelerators. Each affects how commission is calculated and earned.

3. How do accelerators work in commission plans?

Accelerators increase the commission rate once a rep surpasses their quota. For example, a rep might earn 5% up to quota and 10% on additional sales.

4. How is OTE related to commission calculation?

OTE (On-Target Earnings) includes base salary and commission. To hit OTE, reps must meet their quota based on their commission rate.

5. What tools can help calculate commission accurately?

Sales commission software like Remuner automates calculations, integrates with CRMs, and ensures accurate, real-time results across complex plans.