Table of contents

What is a clawback?

A clawback is when a company recovers commission or bonus payments previously paid to a salesperson—usually because the sale falls through, the customer churns early, or terms of the deal aren’t met.

Example: If a rep earns commission on a contract, but the client cancels within 30 days, the company may “claw back” that commission.

Clawbacks protect businesses from paying incentives on deals that don’t bring in long-term revenue. But they can also impact rep morale if not clearly communicated or fairly implemented.

Why are clawbacks important in sales compensation?

Clawback policies serve several essential purposes:

Protecting company revenue

A clawback ensures that a company only pays for revenue that is realized. If a deal falls through, the company can recover the commission, which helps maintain financial stability and prevents losses from overcompensation.

For fortune 100 companies, where millions of dollars in financial results are at stake, these provisions are particularly critical.

Aligning incentives with performance

Sales incentives align with genuine sales performance when clawback rules are in place. Representatives are encouraged to pursue deals that are likely to be successful and profitable rather than chasing high-risk sales that might not materialize. This also prevents poor performance from negatively impacting the company’s financial statements.

Encouraging sustainable sales practices

These policies discourage behavior that prioritizes short-term gains over long-term customer relationships. Salespeople must thoroughly vet prospects and ensure that deals are solid, sustainable, and beneficial for the company. They also contribute to better corporate governance practices.

How do clawbacks work in sales compensation?

A clawback is typically triggered by specific events outlined in a sales compensation plan. Here are some common scenarios where a clawback might apply:

Customer non-payment

When a customer fails to pay for a product or service, the company may issue a recovery of the commission paid to the salesperson. For example, a rep closes a $100,000 deal with a 10% commission. If the customer does not pay, the $10,000 commission becomes subject to clawback.

Product returns or cancellations

When products are returned or services are canceled within a specific period, a recovery policy ensures that the company does not pay commissions on sales that do not contribute to the bottom line. For instance, if a $50,000 sale is canceled and the salesperson has already received a $5,000 commission, the company can recover that amount.

Contract violations or fraud

If a deal is found to violate company policies or involves fraudulent activity, this policy allows the company to reclaim the commission. It discourages unethical practices and protects the company from potential securities and exchange commission investigations or other corporate welfare risks.

Real-world examples of clawbacks in sales compensation

To better understand how clawbacks work in real-world sales compensation plans, consider these examples:

Subscription-based SaaS company

A SaaS company pays its sales team based on annual recurring revenue (ARR). The compensation plan includes a clawback provision, stating that if a customer cancels their subscription within the first six months, the commission is subject to clawback.

For instance, a sales rep closes a deal worth $120,000 ARR and earns a $12,000 commission. If the customer cancels after three months, the company enforces the clawback and recovers the $12,000 already paid.

Retail company with high return rates

A retail company experiences high product return rates due to size and color issues. To protect its revenue, the company implements a clawback policy for sales returned within 30 days. A sales rep sells $10,000 worth of clothing and earns a 5% commission ($500). If $2,000 of that merchandise is returned, the company claws back $100 of the commission.

Enterprise B2B sales team

An enterprise sales team earns large commissions for deals over $500,000. Their compensation plan includes a provision for any deal that does not result in payment within 90 days. If a sales rep closes a $600,000 deal with a 15% commission ($90,000) and the customer fails to pay, the company recovers the full commission amount. Such policies, often seen in executive compensation, help prevent financial crises caused by unrecovered revenue.

Factors to consider when implementing clawbacks

While these policies are a critical tool, they must be implemented thoughtfully. Consider these factors:

1. Balance between risk and reward

A fair policy balances the company’s interests and the sales team’s motivation. If it’s too strict, it can demotivate employees. Policies inspired by frameworks like the Dodd-Frank Act or the Sarbanes-Oxley Act often strike this balance, ensuring recoveries are proportionate to the circumstances.

2. Timing of the clawback policy

Decide when a clawback should be applied. Some companies choose to enforce clawbacks only for sales that fail within a short period (e.g., 30 to 90 days), while others might extend the timeframe up to a year. The timing should align with the company’s typical sales cycle and the expected time it takes to identify whether a deal will be profitable.

3. Transparency and communication

Clear communication about clawback policies is crucial. Sales representatives should understand the terms and conditions related to clawbacks and how these rules will affect their compensation. Regular updates, training sessions,community development initiatives and transparent policy documents help ensure everyone is aligned and aware of potential clawback scenarios.

4. Data-driven decision making

Use data to identify patterns in customer cancellations, returns, or non-payments. Analyzing historical data allows companies to refine their clawback policies to target the right scenarios and reduce the risk of overcompensation. For example, if a particular product or market segment has a high return rate, a more stringent clawback might be appropriate.

By considering these factors, companies can implement clawback policies that protect revenue while maintaining a fair and motivating sales compensation plan.

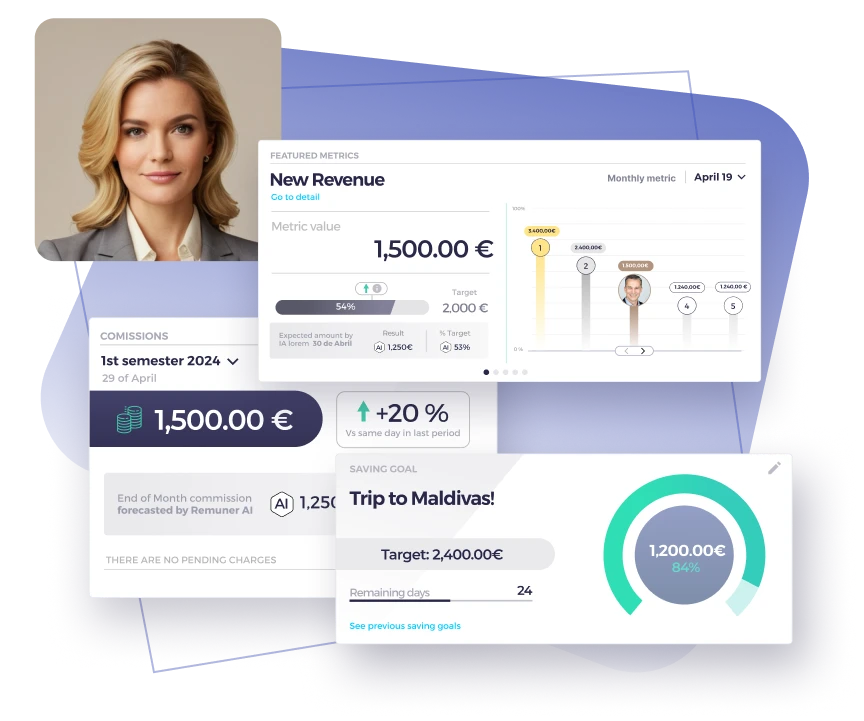

How Remuner Streamlines Clawback Management

Remuner transforms the way companies handle clawback provisions in their sales compensation plans. By automating complex processes, the platform ensures clawbacks are calculated accurately and enforced efficiently, eliminating manual errors and saving time. With real-time data integration and customizable policies, Remuner helps businesses maintain compliance while providing clear visibility for sales teams.

This transparency fosters trust and motivation among employees, as they understand exactly how and why adjustments are made. Whether dealing with cancellations, non-payment, or returns, Remuner streamlines clawback management, allowing companies to protect revenue and focus on driving sustainable growth.

Explore Remuner’s comprehensive sales compensation software to streamline your compensation plans and drive your business growth.