Table of contents

What Is Residual Commission?

Residual commission is a compensation structure where sales reps continue to earn a percentage of the revenue generated from a customer’s ongoing purchases or subscriptions.

Unlike one-time commissions, which only reward the initial sale, this model ensures continuous income for sales professionals as long as their customers remain active.

Example of Residual Commission:

- A sales rep closes a deal with a SaaS company that pays $1,000 per month.

- They earn 5 % residual commission on the monthly revenue.

- As long as the client stays subscribed, the rep receives $50 every month.

- If the customer stays for five years, the rep earns $3,000 in total commissions from one sale.

This system rewards sales reps for bringing in high-value, long-term customers rather than just focusing on quick, one-time deals.

How Does Residual Commission Work? (With Examples)

Residual commission structures vary based on commission rates, sales volume, and contract length. Here are the most common models:

1. Percentage-Based Residual Commission

Sales reps earn a fixed percentage of the revenue from each customer over time.

Example:

- A financial advisor signs a client for a $5,000 investment plan.

- The advisor earns 2 percent of the annual account balance as commission.

- If the client’s account grows, their earnings also increase.

2. Tiered Residual Commission

Sales reps earn different commission percentages based on performance.

Example:

- 3 percent commission for customers retained for one year.

- 5 percent commission for customers staying over three years.

- 7 percent commission if a customer stays over five years.

This structure encourages reps to focus on customer retention rather than just signing new deals.

3. Fixed-Time Residual Commission

Reps receive commissions for a set period, such as 12 or 24 months after closing a deal.

Example:

- A telecom sales rep earns $10 per month per new customer for the first 24 months.

- After that period, the company retains all revenue.

This model ensures short-term stability while keeping costs controlled for the business.

Top 5 Benefits of Residual Commission for Sales Teams

1. Encourages Long-Term Customer Relationships

Sales reps are incentivized to provide excellent service so customers continue purchasing.

2. Provides Consistent, Predictable Income

Unlike one-time commissions, this model allows sales reps to build a steady income stream over time.

3. Increases Retention of Top Sales Talent

Reps earning recurring commissions are less likely to leave since they benefit from past deals.

4. Aligns Sales Goals with Company Growth

Reps focus on customer success, reducing churn and increasing territory volume commission earnings.

5. Rewards Long-Term Success, Not Just Short-Term Wins

Sales teams can focus on sustainable revenue growth instead of chasing quick wins.

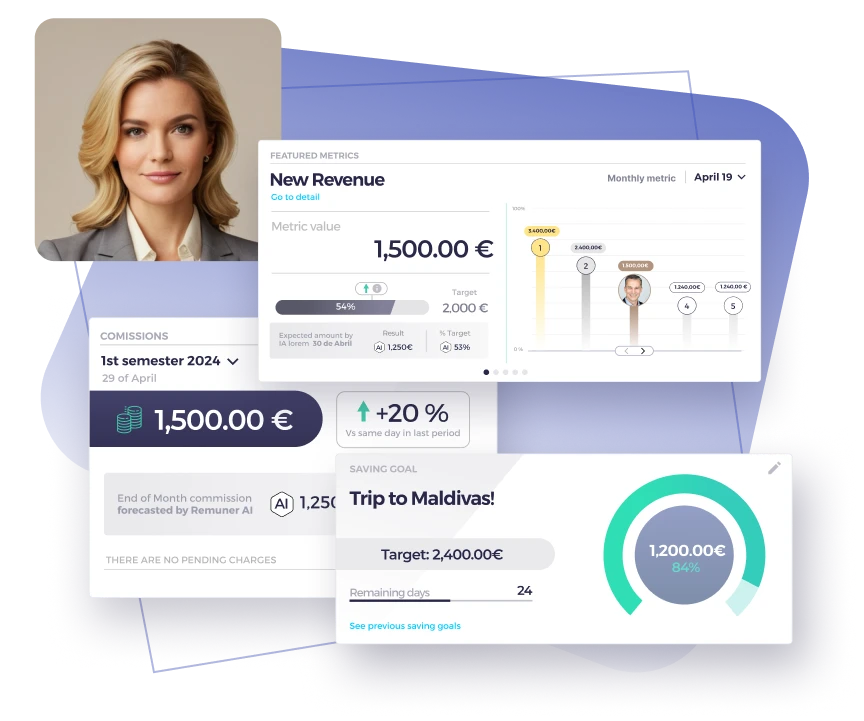

A tool like Remuner can automate residual commission calculations, ensuring transparency and accuracy.

Challenges of Residual Commission (And How to Fix Them)

While this type of commission has clear advantages, it also presents challenges.

1. Delayed Earnings for New Reps

Since commissions depend on long-term revenue, new hires might struggle financially in the beginning.

- Solution: Offer a base salary or commission-only draw to support new sales reps.

2. Managing Commission Payouts

Tracking commissions over months or years can be complex, especially in high-volume businesses.

- Solution: Use compensation management software to automate calculations and track performance.

3. Customer Churn Affects Earnings

If customers cancel subscriptions, the rep loses commissions, creating income instability.

- Solution: Implement retention bonuses for reps who keep customers engaged for extended periods.

When to use Residual Commission? A guide for businesses

Not every sales team benefits from a residual commission structure. It works best when:

- Revenue depends on recurring payments – SaaS, insurance, and financial services thrive on repeat business.

- Long-term relationships drive value – The company wants reps to nurture customer relationships beyond the initial sale.

- Customer churn is a major concern – Retaining customers is as valuable as acquiring them.

- Sales cycles are long – If deals take months to close, residual commissions ensure continuous motivation.

Revenue depends on recurring payments – SaaS, insurance, and financial services thrive on repeat business. Forbes highlights how subscription-based models are transforming industries, making residual commissions a natural fit for businesses with recurring revenue streams.

Examples of Residual Commission in Different Industries

Software (SaaS) Sales

- A SaaS company offers 5 % monthly residual commission on customer subscriptions.

- If a rep signs a client for a $10,000 per year plan, they earn $500 annually as long as the client stays.

Insurance Sales

- An insurance agent earns 2% residual commission on annual policy renewals.

- If the policyholder remains for ten years, the agent earns more than from a one-time sale.

Financial Advisory Services

- A financial planner gets 0.5 percent commission on assets managed for every client.

- If their portfolio grows, their commission increases over time.

How to Track and Manage Residual Commissions Efficiently

Tracking ongoing commissions manually can lead to errors and disputes.

Best practices for tracking:

- Use real-time performance dashboards – Monitor commission earned per customer.

- Automate payouts – Reduce manual errors and ensure accurate commission distribution.

- Set clear commission rates and timelines – Define how long commissions last and what percentage applies.

Remuner simplifies commission management, helping businesses automate compensation tracking, quota calculations, and performance analytics.

FAQs About Residual Commission

How is residual commission calculated?

It is usually a fixed percentage of revenue from a customer’s recurring payments over time.

What industries use residual commissions?

Common in SaaS, financial services, insurance, and telecom—any industry with subscription-based revenue.

How long do reps earn residual commission?

This depends on the commission structure—some companies pay for one to three years, while others offer lifetime commissions.

What happens if a customer cancels?

Reps stop earning commission unless the company offers churn protection bonuses.

How can businesses track residual commissions?

Using compensation management software like Remuner, which automates calculations and provides real-time tracking.

Final Thoughts

Residual commissions create long-term income opportunities for sales reps while aligning company goals with customer retention.

For companies looking to automate and optimize their commission plans, Remuner provides a data-driven solution that ensures accurate tracking and fair payouts.

Want to manage commissions effortlessly? Discover how Remuner can streamline your compensatio structures today. Book a free demo today!