Variable pay is a powerful tool for motivating sales teams and driving business growth. It goes beyond the standard base salary, rewarding employees for hitting specific targets or performance levels. In sales, it is often tied to key metrics like revenue, quotas, or other sales goals. This approach helps businesses align compensation with outcomes and ensures that salespeople have a clear incentive to perform at their best.

Table of contents

This guide explores what variable pay is, why it matters in sales compensation, and how it connects with sales incentives, quotas, on-target earnings (OTE), and overall sales performance. We’ll also share some examples to show how various sectors use this type of compensation effectively.

What is variable pay?

Variable pay is a type of compensation that changes based on an employee’s success in meeting specific goals. Unlike fixed pay, which stays the same regardless of results, this pay structure rewards employees for hitting performance targets. In sales roles, it typically includes commissions, bonuses, or other rewards tied to achieving goals.

This compensation can take many forms, such as paying a percentage of sales, offering bonuses for meeting quotas, or creating tiered commissions where rates increase with sales volume. The key is that the amount earned through variable pay depends on how well the salesperson performs.

Why is variable pay important in sales?

This compensation method plays a crucial role in sales because it directly links earnings to performance. Here’s why it matters:

- Motivates salespeople: When salespeople know they can earn more by closing deals, they’re more likely to stay motivated and push harder to reach targets. Variable pay acts as a strong sales incentive that keeps them focused on achieving their goals.

- Aligns goals with business objectives: Tying compensation to quotas or revenue targets helps businesses align individual performance with company goals. This makes sure that everyone is working toward the same outcomes.

- Helps attract top talent: Many sales professionals seek roles that offer significant earnings potential through variable pay. Companies with attractive compensation plans can attract and retain high-performing salespeople.

- Boosts sales performance: By rewarding top performers, variable pay encourages healthy competition among the sales team. This often results in higher overall sales and improved business outcomes.

Key components of variable pay in sales

When structuring compensation for sales teams, several key elements come into play:

- Quotas: Quotas are the targets salespeople need to hit in order to earn variable pay. These targets can be based on revenue, the number of deals closed, or other performance metrics. Hitting or exceeding quotas often triggers commissions or bonuses.

- OTE (On-Target Earnings): OTE refers to the total expected earnings for a sales role, combining both base salary and variable pay. For example, if a salesperson’s OTE is $100,000, it might include a $60,000 base salary and $40,000 in commissions or bonuses tied to performance. This structure gives salespeople a clear understanding of their potential earnings.

- Sales incentives: These are the rewards tied to reaching specific goals, such as commissions, bonuses, or non-monetary perks like trips or gift cards. Sales incentives are a key part of variable pay and are designed to motivate employees to hit their targets.

- Commission structure: The sales commission structure outlines how the variable part of the compensation is calculated. It could be a flat rate for all sales, tiered rates that increase as sales volume grows, or a combination of base salary and commission.

Examples in action

To understand how variable pay works in real-world situations, let’s look at examples across different industries:

1. Technology and Software

- Pay structure: In the tech sector, companies often offer commissions on new software sales or renewals. A software salesperson might earn a base salary of $60,000 with an OTE of $120,000, where the extra $60,000 comes from commissions based on meeting sales goals.

- Sales incentives: A sales rep could earn a 10% commission on each new deal closed, with the commission rate rising to 12% for exceeding 125% of the quota. This encourages continued effort even after hitting initial targets.

2. Pharmaceuticals

- Pay structure: In the pharmaceutical industry, salespeople might earn bonuses for increasing market share or selling a specified volume of products. This is often paired with a lower base salary due to the longer sales cycles involved.

- Sales incentives: Bonuses might be tied to exceeding sales targets during a product launch, with a rep potentially receiving a $5,000 bonus for surpassing expectations.

3. Financial Services

- Pay structure: Financial advisors often have compensation plans that combine fees for services and commissions on product sales. Their OTE might be $150,000, with $50,000 coming from variable pay tied to meeting sales targets.

- Sales incentives: Advisors may earn commissions on financial products, such as 5% of the annual premium for insurance policies sold, or a percentage of assets under management brought into the firm.

Balancing variable pay and base salary

While variable pay is a powerful motivator, it’s essential to balance it with a reasonable base salary. If the base salary is too low, salespeople may feel insecure about their income. However, if it’s too high, it can reduce the incentive to go beyond their targets. Here’s how to find the right balance:

1. Start with a fair base salary

Ensure that the base salary is enough to cover living expenses and provide financial security. This stable foundation allows salespeople to focus on performing well without worrying about basic needs.

2. Make variable pay meaningful

Set commission rates and bonus amounts that are high enough to motivate employees. When variable pay makes up a significant part of OTE, it encourages sales teams to strive for higher performance.

3. Tailor plans to different roles

Not all sales roles are alike. Inside sales reps, field sales, and account managers might require different combinations of base and variable pay, depending on factors like the length of the sales cycle and the size of deals. Tailoring compensation to each role ensures effectiveness.

How variable pay drives sales performance

The link between variable pay and sales performance is clear: when compensation is directly tied to performance, salespeople are motivated to hit their goals. Here’s how this system improves sales outcomes:

- Rewards top performers: The best performers naturally earn the most, which motivates them to continue excelling and inspires others to follow suit.

- Encourages goal-setting: Tying compensation to quotas or other metrics pushes salespeople to set and reach ambitious targets, driving overall better results.

- Increases engagement:When salespeople know they can control their earnings by performing well, they are more engaged and motivated to succeed.

Optimizing variable pay plans for success

To get the most out of variable pay strategies, companies need to ensure their compensation plans are clear, fair, and aligned with their business objectives. Here are some tips for optimizing these plans:

- Set realistic quotas: Make sure quotas are challenging but achievable. If goals are too difficult, salespeople may feel discouraged. If too easy, the plan won’t push them to perform at their best.

- Regularly review compensation plans: Keep up with industry trends to ensure your variable pay remains competitive. Regularly adjusting quotas, commission rates, or bonus structures ensures the plan stays motivating.

- Use data to improve plans: Analyzing sales performance data can help you identify which aspects of your plan are working and where changes might be needed. Adjusting your variable pay structure based on data ensures it continues to motivate your sales team.

- Add non-monetary incentives: While financial incentives are key, perks like recognition, trips, or professional development opportunities can also motivate employees.

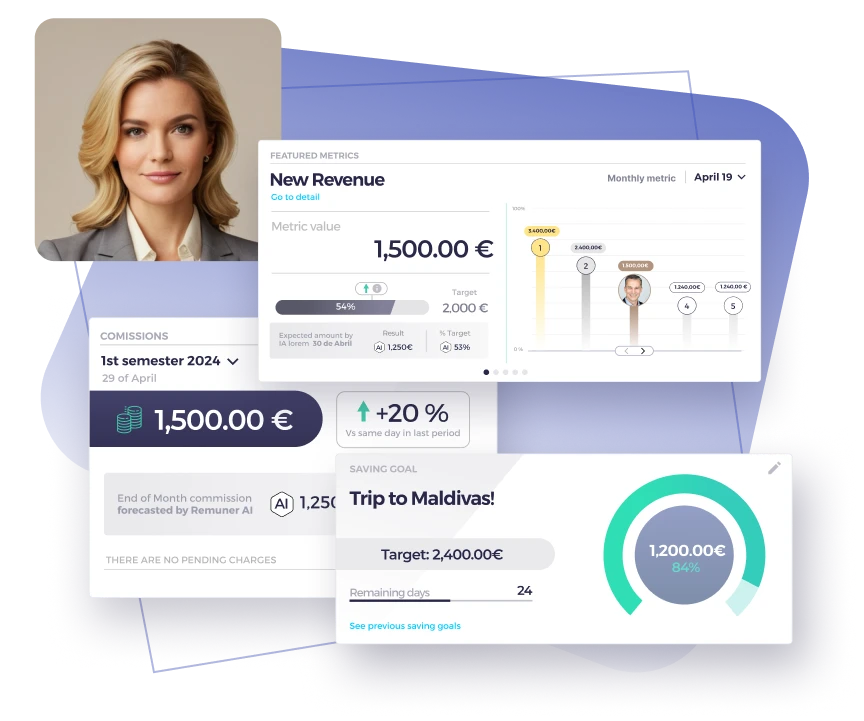

Start using variable pay in your company

Variable pay is a crucial part of sales compensation, linking earnings to performance. It motivates salespeople, aligns their efforts with company goals, and rewards top achievers. Understanding how to design an effective compensation plan, balance it with base salary, and adjust it for different sales roles can significantly boost sales performance.

To optimize variable pay, companies should set realistic quotas, regularly review their compensation plans, and use data to refine their approach. When executed correctly, this compensation method not only motivates sales teams but also drives long-term business growth.